Tracking Changes in the Value of Residential Real Estate in German Cities

High rents, gentrification and lack of housing construction: affordable housing has been scarce in Germany for years. The COVID-19 pandemic, historically high inflation and rising interest rates are increasing fear of a growing housing crisis. From mid-2022, real estate prices collapsed by up to 20 per cent when adjusted for inflation. How did it get this far? How have real estate prices in Germany developed over the past 60 years? And what conclusions can be drawn for the future? The German Real Estate Price Index (GREIX), developed by economists from the Cluster of Excellence ECONtribute and the University of Bonn, provides answers and establishes novel standards for the analysis of German real estate markets based on cutting-edge data.

New benchmark for the analysis of German real estate markets

For the first time, the GREIX provides a highly up-to-date picture of the price trends on real estate markets in 18 German cities since the 1960s to the level of individual neighborhoods. The database covers long-term trends in real estate markets and can be used to analyze developments such as rising inflation in ist historical context. Although numerous data on real estate prices are available in Germany, there is only an inaccurate overview of the trends on the real estate market.

Researchers from the Cluster of Excellence ECONtribute: Markets & Public Policy and the University of Bonn collaborated with appraisal committees (GAAs) across Germany to systematically analyze the development of real estate prices. With GREIX, ECONtribute implements a tool that enables this analysis – publicly accessible and free of charge. Via the database website, property prices can be compared transparently covering the entire time period specified to the level of individual city districts. The database is a major progress towards more transparency in the German real estate market and facilitates analyzing the German real estate market based on the highest scientific standards and highly up-to-date.

The German Real Estate Index (GREIX) is available here.

Results at a glance

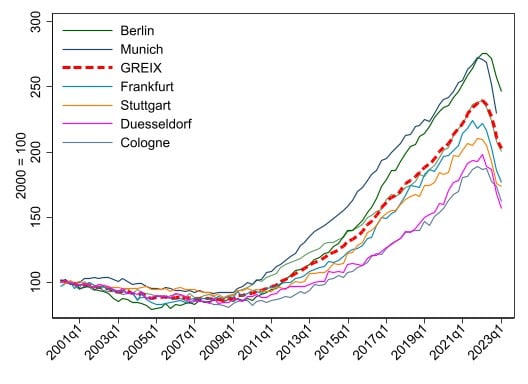

Profiteers: Property owners have been able to achieve historically high asset gains in recent years. The city with the highest performance since 2000: Berlin.

Polarization: The difference in price between the most expensive and least expensive neighborhoods within German cities has more than doubled over the past 30 years.

Price drop: Since mid-2022, real estate prices have collapsed by almost 15 per cent in real terms in comparison with their peak.

Forecast: Prices will continue to decline – but at a slower pace. At the end of the current quarter (Q2), prices in Germany as a whole are expected to have fallen by just under 20 per cent in real terms in comparison with their peak.

Results in detail

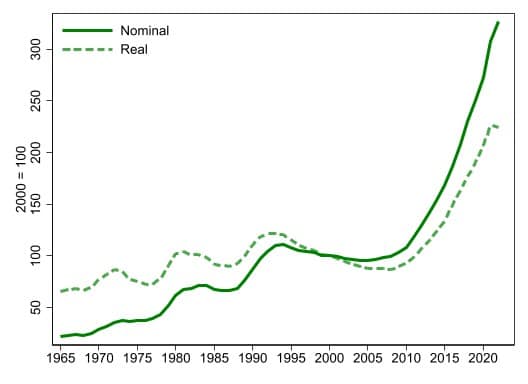

Profiteers : Berlin-Kreuzberg vs. Hamburg-Eppendorf

The new real estate indices cover three major cycles that have characterized the German housing markets over the past 60 years. While property prices continued to rise before the fall of the Berlin Wall 1989, they chrased immediately after reunification and stagnated until the financial crisis of 2007/2008. That was followed by the greatest and longest-lasting property boom in German history so far: Prices rose continuously in most regions until 2022. Major cities such as Berlin, Munich and Hamburg benefited most, while cities such as Dortmund and Chemnitz lagged behind.

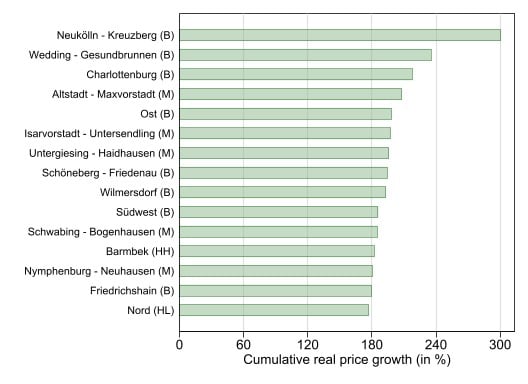

Property owners achieved substantial asset gains during the housing boom. The city with the highest increase in value since 2000 was Berlin, achieving cumulative gains of about 160 per cent adjusted for inflation, followed by Munich and Frankfurt. The value of a typical 100-square-meter apartment in Berlin thus rose by an average of around 300,000 euros in real terms. Price trends varied widely depending on the neighborhood: Real estate prices in Hamburg-Eppendorf increased of just under 240 per cent since 2000, followed by Berlin-Kreuzberg and Munich-Maxvorstadt with more than 180 per cent.

Polarization: Chemnitz-Mitte-West vs. Munich-Schwabing

The detailed city district data enable to map the considerable polarization of housing markets within and between individual cities in recent decades for the first time. The price difference between the most and least expensive neighborhoods within German cities has more than doubled over the past 30 years. Although prices increased across all neighborhoods, the extent varied. In neighborhoods such as Bornheim (Frankfurt) or Kreuzberg (Berlin), for example, prices rose much faster compared to the rest of the city. Among the 18 cities in the sample, Chemnitz-Mitte-West is currently the most affordable neighborhood, while Munich-Schwabing is the most expensive.

Price drop: Düsseldorf vs. Bonn

Real estate prices rose sharply during the COVID-19 pandemic but began to drop in 2022. The indices clearly show that rising interest rates in response to the surge in inflation triggered a change in German real estate market trends that is still underway. In nominal and real terms, sales prices have been falling accross all cities in the sample since mid-2022. In some cities, prices dropped up to 20 per cent in real terms, while the national average was around 15 per cent below the 2022-peak adjusted for inflation. Among others, Düsseldorf, Frankfurt and Hamburg have been affected particularly, while prices in smaller cities such as Bonn fell less sharply.

Forecast: Prices will continue to fall

To obtain real-time data on recent market developments, the research team has developed a dynamic forecasting model for real estate prices based on the latest scientific methods. The latest results suggest that prices will continue to fall in the current quarter (Q2 2023) – but at a slower pace. The researchers predict that prices will fall another 2 per cent in nominal terms compared with the first quarter, roughly equivalent to a 4 per cent decline in real terms. Prices are thus expected to fall by just under 20 per cent on average on national level compared with their peak in mid-2022.

Background

The data of the appraisal committees (GAAs) cover all real estate transactions in (western) Germany over the past 60 years. The GAAs thus possess the largest and most detailed data set in Germany. With funding from the German Research Foundation (DFG), researchers from the Cluster of Excellence ECONtribute have been able to digitize around one million transaction records, enabling to compare them for the first time. The result: the first long-term microdata set on real estate transactions in Germany. Using state-of-the-art statistical methods, the researchers have developed a model to create indices based on highest scientific standards. These provide a comprehensive and regional picture of how housing prices have developed and evolved in 18 major German cities. Using specific regression methods, the team created quarterly housing price indices for three different market segments in each city: Multi-family houses, single-family houses and apartments.

Other German real estate indices are based on alternative data sets, which usually refer to mortgage contracts, online advertisements or appraisals. The only exception is Destatis’ national index, which is also based on GAA data, but is compiled without exchanging information with the GAAs and ensure quality and has only been compiled since the 2000s.

The database will be updated and maintained on a regular basis. Politicians, journalists and the public will thus have access to an analysis of historical, current and future trends in German real estate markets based on highest scientific standards for the first time.